At Thomas Whiting Ltd when we do Financial Planning with our clients, we always reiterate that life insurance and protection is the most important part of planning, as much like a when building a house, if the house doesn’t have good foundations, everything can come tumbling down.

Do you have the right amount of cover for your life and lifestyle?

Are you Family Protected?

What are risks to you Financial plan of being under insured?

There various Types of policy we offer advice on these include:

Home Insurance

Home insurance policies generally cover destruction and damage to a

residences; interior and exterior, the loss or theft of possessions, and

personal liability for harm to other people.

There are three basic levels of coverage exist: replacement cost, actual cash

value, and extended replacement cost/value.

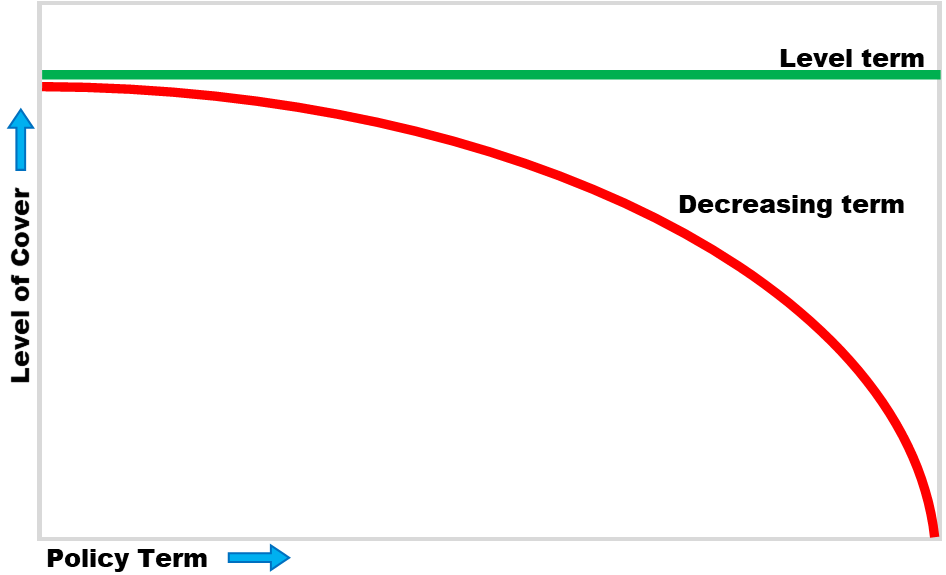

Mortgage Protection

When you get a mortgage to buy your home, you will generally be required to take

out mortgage protection insurance. This is a particular type of life assurance taken out for the term of the mortgage and designed to pay it off on the death of the borrower or joint borrower. In most cases, the lender is legally required to make sure that you have mortgage protection insurance before giving you a mortgage. Mortgage protection should be payable on a joint life, first death basis. This means that the mortgage is repaid on the death of the first borrower if a couple is involved.

You do not have to take out mortgage protection insurance if:

- You are aged over 50

- The mortgage is not on your principal private residence (your home)

- You cannot get the insurance, or can only get it at a much higher premium

than normal - You already have enough life insurance to pay off the home loan if you die

However, some lenders may insist that you take out mortgage protection

insurance as it is highly advised.

Life Assurance

Life insurance pays out a lump sum to your loved ones if you pass away or

are diagnosed with a terminal illness while your policies in place. It’s not a

legal requirement, but it could give your dependents financial stability when

you die.

It can cover any outstanding financial commitments you have – like your

mortgage or loan repayments – so your family won’t be left with payments

they can’t afford after you’re gone.

Critical Illness

Critical illness cover provides a tax-free lump sum to meet the additional costs that someone may face if they find themselves in this situation. The illness need not be terminal.

The range of illnesses and conditions covered can vary from one insurer to another but would typically include the following:

- forms of cancer

- heart attack

- stroke

- coronary artery disease requiring surgery

- major organ transplant

- and many more

Many policies also make provision for payment of the sum assured in the event of

total and permanent disability.

Uses of Critical illness cover:

- Long-term care(home or hospital)

- Medical equipment

- Mortgage repayment

- Enhancing quality of life

- Alterations to living accommodation

Reasons for Claims:

(Source: Zurich claims performance 2020)

Income Protection

Income protection insurance (IPI) pays an income when an accident or illness

prevents someone from earning a living by carrying out their normal occupation.

Many insurers also offer IPI to people whose main responsibilities are in the family home rather than earning money outside it.

This is because, although they may not actually earn an income, costs may be

increased if they are ill or injured – for example, childcare fees or housekeeping

services.

Reasons for Claims:

(Source: Zurich claims performance 2020)

Health Insurance

The main insurance is CIC (critical illness cover), this insurance would be paid by you each month at a set amount. critical illness, cover, is an insurance product in which the insurer is contracted to typically make a lump sum cash payment if the policyholder is diagnosed with one of the specific illnesses on a predetermined list as part of an insurance policy. Another insurance (this is not common) is fracture cover. This can get claimed if you receive a fracture from any scenario. This is also paid at a set amount each month and is an additional insurance cover.

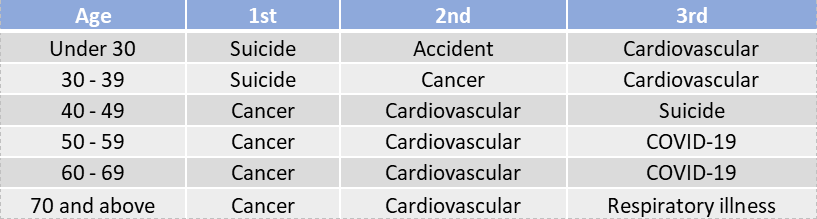

Most common reason to claim by age band one:

(Image Source: Aviva Life & Pensions UK Limited 2021)

Business Protection

Business protection is an insurance contract that helps protect a business from the financial effects of key people being diagnosed with a critical illness or dying

Business protection is available for partnerships, shareholders, sole traders, and key employees.

With new product features and products in this market place constantly evolving, it is our job to find the best and most suitable product for our clients needs. We offer whole of market advice.